Life science organizations face a new benchmark for success. Integrating artificial intelligence, digital health, and real-world evidence has become essential for regulatory leadership and commercial dominance. The pharmaceutical industry's transformation over the past decade reveals that companies harnessing these advanced technologies consistently achieve faster regulatory approvals, higher rates of first-in-class innovations, and more robust market positioning. This article examines the quantitative evidence behind this shift and provides strategic insights for executives seeking to maintain competitive advantage in an increasingly data-driven regulatory environment.

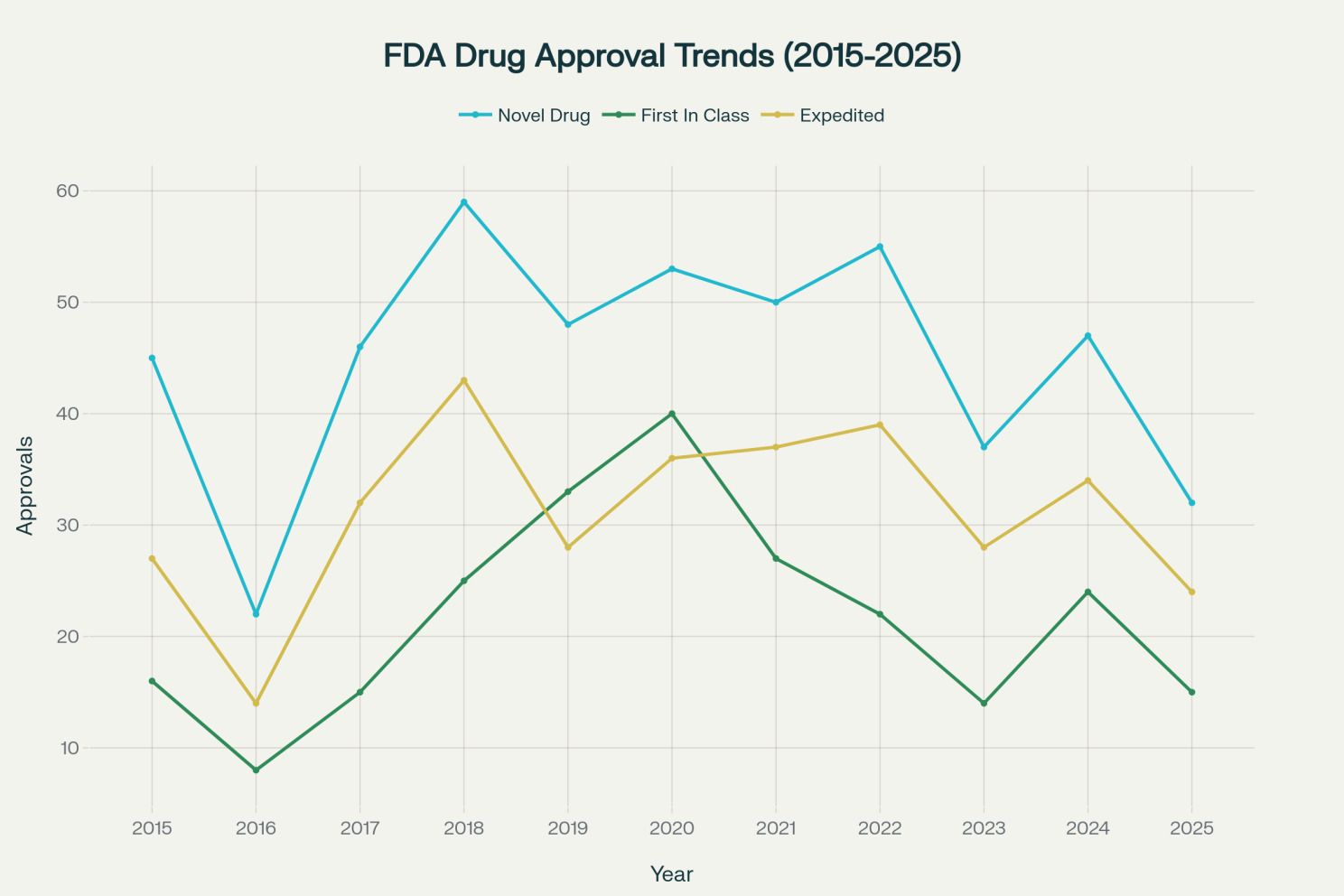

Growth of expedited FDA review pathways: Policy drivers and strategic implications

In the past decade, expedited FDA programs, including accelerated approval, breakthrough therapy, fast track, priority review, and orphan drug designation, have fundamentally altered the drug development landscape. These pathways emerged from legislative initiatives including the Orphan Drug Act (1983), FDA Modernization Act (1997), and critically, the 21st Century Cures Act (2016), which provided the regulatory framework and financial incentives for expedited development.[1][2][3][4][5][6][7]

The 2023 Food and Drug Omnibus Reform Act further strengthened accountability and clarified accelerated approval standards, responding to concerns about confirmatory trial completion. The result has been a regulatory environment that actively rewards innovation addressing serious unmet medical needs.[7][8]

The data validates this transformation. Oncology and rare disease therapies now comprise more than 80 percent of accelerated approvals, reflecting both clinical urgency and the sector's emphasis on addressing conditions with limited therapeutic options. Recent FDA annual reports confirm that more than half of all new approvals between 2018 and 2024 relied on at least one expedited pathway, with some years showing usage rates as high as 78 percent.[9][10][11][12][13][14]

Economic incentives have made these pathways particularly attractive. Tax credits, market exclusivity extensions, expedited review fee waivers, and priority vouchers create compelling business cases for rare disease and breakthrough therapy development, despite smaller patient populations. Moreover, FDA approval of first-in-class drugs sends positive signals to innovators and investors about regulatory feasibility, stimulating further investment and innovation within disease classes.[6][15][16]

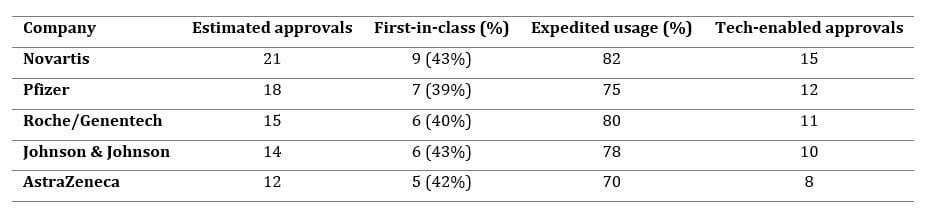

Top Pharma Companies: Total vs Tech-Enabled Approvals (2015-2025) [18][19][1]

Technology's influence on regulatory success: From discovery to commercialization

The integration of advanced technologies across the drug development lifecycle has become a defining characteristic of high-performing pharmaceutical organizations. This transformation spans multiple domains:[17][18][19][20][21][22][23]

Drug discovery acceleration. AI platforms have reduced preclinical screening time by 50 to 70 percent, identifying novel targets and predicting ADMET (absorption, distribution, metabolism, excretion, toxicity) properties earlier in development. Machine learning models trained on extensive clinical trial databases can predict trial success probability with unprecedented accuracy, enabling better go or no-go decisions and allowing companies to "fail fast, fail cheap".[24][25][26]

Clinical trial optimization. Digital health platforms and advanced analytics are revolutionizing trial execution. Patient recruitment has accelerated dramatically, with companies such as Amgen reporting that AI-driven tools have doubled clinical trial enrollment speed. Predictive modeling optimizes protocol design, endpoint selection, and patient stratification, reducing both trial duration and costs. Sanofi's partnership with OpenAI and Formation Bio has reduced patient recruitment timelines "from months to minutes" using generative AI.[27][28]

Real-world evidence for regulatory submissions. RWE has become essential for supporting FDA approvals, particularly for accelerated approvals in rare diseases where traditional randomized controlled trials are impractical. Between 2022 and 2024, approximately 25 percent of FDA supplemental approvals for expanded indications or populations utilized RWE, with usage highest in oncology (about 44 percent of RWE-supported approvals). RWE is predominantly used for supporting efficacy and safety (49 percent), adding context to pivotal trial data, and justifying expanded indications (78.2 percent of labeling expansions using RWE).[29][30][31][32]

FDA's own digital transformation. The agency itself has embraced technology to enhance review capabilities. The FDA launched ELSA, an AI tool in 2025, to accelerate reviews, summarize adverse events, and identify inspection targets, with potential to reduce approval times from traditional 10 to 12 month reviews to as little as one to two months under new voucher programs. FDA guidance from 2025 highlights robust expectations for RWE and AI use in regulatory submissions, emphasizing transparency, fitness for purpose, and early agency engagement.[20][22][33][34][35]

Market leaders leveraging technology for competitive advantage

The relationship between technology adoption and regulatory success is particularly evident when examining leading pharmaceutical manufacturers. Analysis of regulatory data and industry disclosures reveals that top performers have systematically invested in AI partnerships, digital health platforms, and RWE infrastructure:

Tech-enabled approvals are defined as regulatory successes that utilized modern AI, machine learning, digital health platforms, or real-world data for patient selection, evidence generation, and submission strategy. This includes partner-driven analytics, integration of large patient datasets, and predictive modeling as employed by the leading firms.[17][18][19][36][21]

Strategic partnerships defining competitive position

Novartis leads with 21 approvals and the highest tech-enabled percentage (82 percent), driven by partnerships with IBM, Microsoft, MIT, QuantumBlack, and BenevolentAI focused on advanced analytics, patient stratification, and RWE-driven trial design. Pfizer has deployed 18 approvals with 75 percent tech-enabled, spanning drug discovery collaborations (MIT, IBM, Insilico, Atomwise), clinical development (Tempus, Saama), and patient support (CytoReason), with AI campaigns demonstrating 34 percent higher engagement and 28 percent improved adherence.[24][28][37][38]

Roche's acquisition of Flatiron Health established the largest RWE oncology database with over 2 million patient records, enabling precision medicine and AI-driven target identification through partnerships with Owkin, PathAI, and Syapse. AstraZeneca's collaborations with Microsoft (AI Factory for Health), Alibaba, and Tencent demonstrate global digital integration spanning 12 approvals.[28][32][39][24]

These partnerships represent more than technology acquisition; they reflect strategic repositioning around data as a core asset. Companies building robust AI and RWE platforms gain sustained advantages in trial design, regulatory strategy, and commercial positioning.[32][40][41]

Top pharma companies: total vs tech-enabled approvals (2015-2025) [27][31]

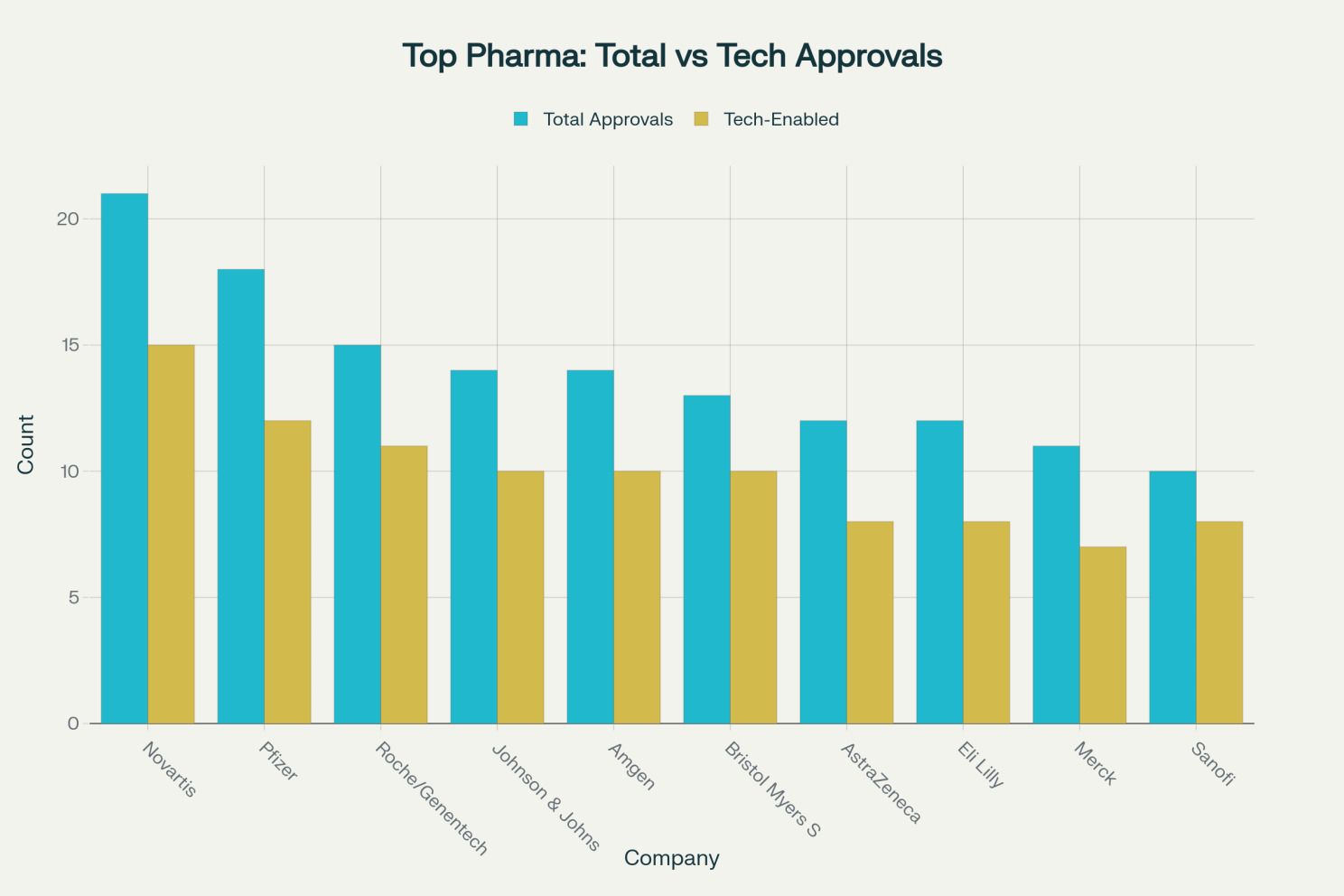

Therapeutic areas advancing FDA process with expedited reviews: tailored strategies for complex indications

Therapeutic area dynamics reveal how technology adoption addresses specific evidence generation challenges. Oncology and rare diseases represent over 80 percent of expedited FDA approvals, but the strategic application of technology varies significantly across indications.[9][10][11]

Oncology: biomarkers and precision medicine. Oncology's dominance (145 approvals, 85 percent expedited) reflects both disease burden and the availability of surrogate endpoints that can be measured earlier than overall survival. Digital health technologies and RWE are particularly valuable for biomarker discovery, patient stratification, and demonstrating real-world effectiveness. Companies leveraging platforms such as Flatiron Health's database can identify responders versus non-responders, enabling precision medicine approaches with higher success rates.[1][23][26][28][42][43][44]

Rare diseases: addressing small population challenges. Rare diseases (98 approvals, 78 percent expedited) present unique challenges where traditional randomized controlled trials may be infeasible due to limited patient populations. Digital endpoints, remote monitoring, and patient registries enable continuous RWE collection, supporting both initial approvals and label expansions. Companies that master these approaches secure orphan drug designation benefits including seven years of market exclusivity and tax incentives.[5][6][15][45][46]

Emerging therapeutic areas. Neurology (28 approvals, 58 percent expedited) and cardiovascular diseases (25 approvals, 52 percent expedited) are increasingly adopting digital strategies. Wearables and remote patient monitoring provide continuous data streams for conditions such as heart failure and movement disorders, enriching evidence packages beyond what traditional episodic clinical assessments can deliver.[23][28][47]

FDA approvals by therapeutic area (2015-2025) [16][1][15]

FDA approvals by therapeutic area from 2015-2025, with oncology and rare diseases leading, colored by expedited pathway usage percentage

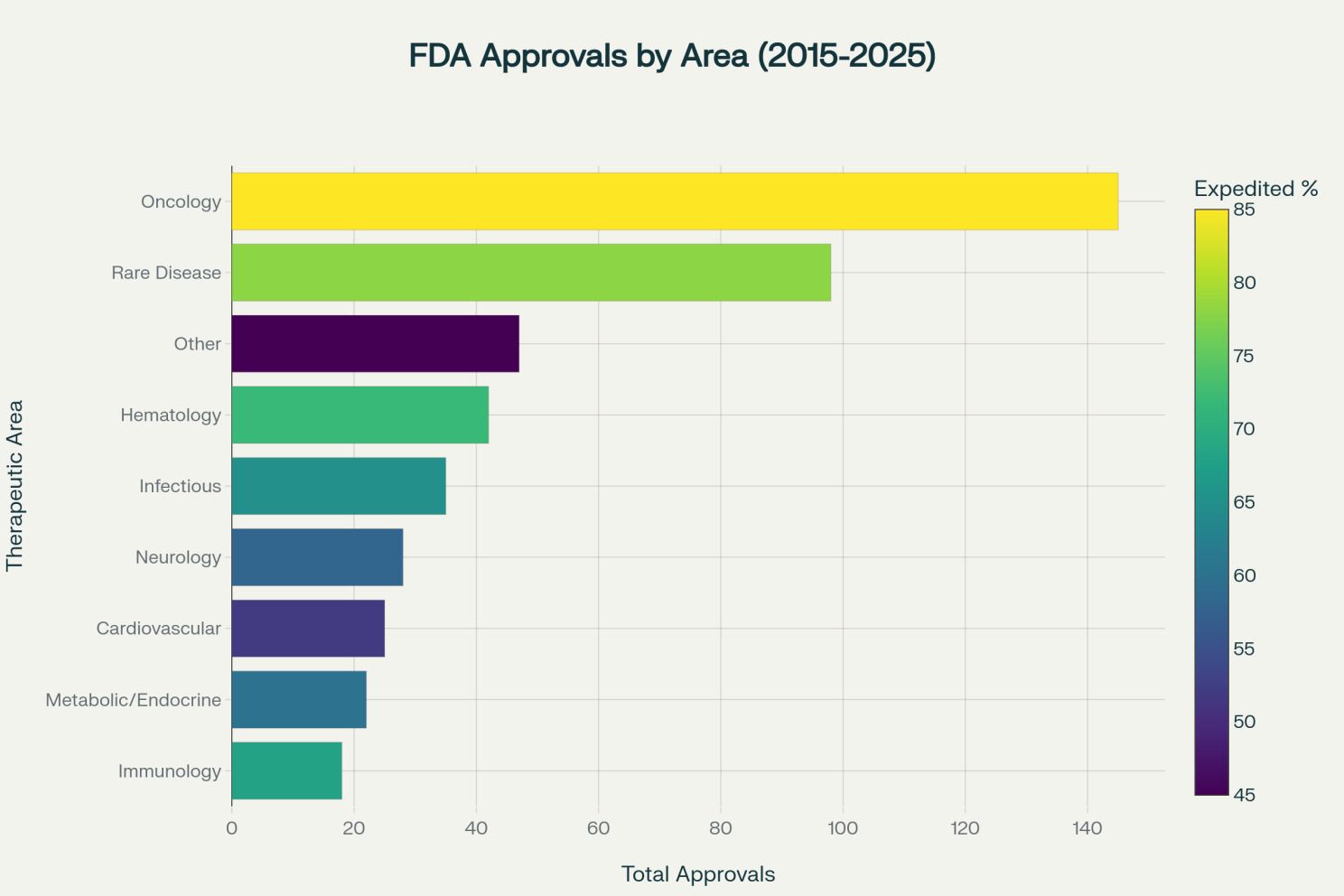

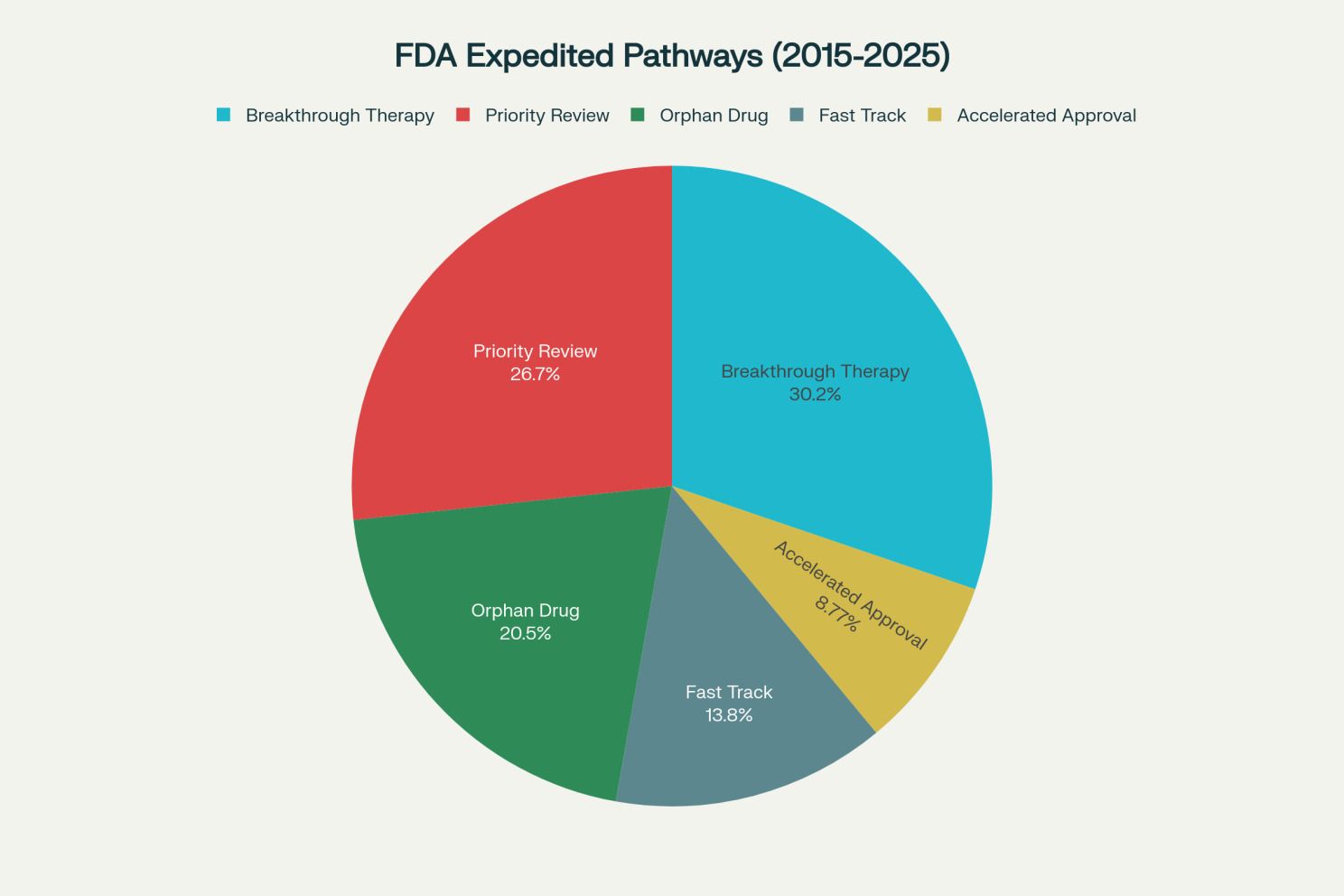

Distribution and impact of expedited pathways: Strategic pathway selection

The distribution of expedited pathways reflects both regulatory priorities and sponsor strategy. Breakthrough therapy designation (317 approvals, 54 percent success rate) and priority review (280 approvals, 62 percent success rate) are most common, offering strategic advantages including early regulatory interaction, rolling review, and increased flexibility for trials involving high-risk or rare patient populations.[1][2][3][4][48]

Accelerated approval (92 approvals, 54 percent success rate) has particular relevance for technology-enabled strategies, as it allows approval based on surrogate endpoints with confirmatory trials required post-approval. This pathway is especially valuable in oncology, where biomarkers and intermediate clinical endpoints can be established through RWE and digital monitoring.[8][9][42][48]

Companies frequently pursue multiple designations across portfolios to maximize approval probability. In 2024 alone, 57 percent of applications had accelerated, breakthrough, and/or fast-track designation. This reflects sophisticated regulatory strategy where sponsors leverage complementary pathways to derisk development timelines and accelerate patient access.[13]

Distribution of FDA expedited pathways 2015-2025 [50][1]

Distribution of FDA expedited review pathways used from 2015-2025, with Breakthrough Therapy and Priority Review being most common

The rise of first-in-class drug approvals: Innovation drivers and strategic opportunities

FDA data confirms a dramatic increase in first-in-class drug approvals, with the proportion rising from 33 percent in 2017 to 54 percent in 2021, and maintaining levels above 40 percent through 2025. This surge reflects multiple converging factors that technology-forward companies are uniquely positioned to exploit.[1][49][50][51][52]

Scientific breakthroughs enabled by AI. Advances in genomics, transcriptomics, and AI-driven target identification enable discovery of novel mechanisms that were previously undiscoverable. AI platforms analyze multi-omics data (genomics, proteomics, metabolomics) to identify previously unknown disease mechanisms and druggable targets. Companies using these tools can pursue truly differentiated mechanisms rather than incremental improvements to existing drug classes.[25][26][27][53][54]

Policy incentives for differentiation. First-in-class drugs receive 81 percent expedited designation rates versus 30 percent for follow-on drugs, along with shorter review times and premium pricing power. The FDA actively prioritizes drugs addressing serious conditions without effective treatments, particularly in rare diseases and oncology. These incentives create powerful economic rationales for pursuing novel mechanisms.[5][6][7][16][51]

Economic signals encouraging innovation. Contrary to concerns that first-in-class approvals might discourage follow-on innovation, research shows that FDA approval of pioneering drugs signals regulatory feasibility to investors, stimulating additional innovation and market entry rather than suppressing it. This creates virtuous cycles where initial breakthroughs catalyze broader therapeutic class development.[16]

Technology as competitive moat. First movers with robust AI and RWE platforms gain sustained advantages that extend beyond initial approval. Predictive modeling reduces failure rates by identifying optimal patient populations before expensive clinical trials begin. Enhanced evidence generation through RWE complements limited clinical trial data, particularly valuable for rare diseases where large randomized controlled trials are infeasible. Post-market surveillance using digital endpoints and remote monitoring enables continuous RWE collection for label expansions and lifecycle management.[23][28][31][32][47][55][25]

The strategic implications are clear: companies lacking digital transformation and RWE capabilities face severe competitive disadvantage. Analysis shows that 70.5 percent of approvals from top pharmaceutical companies already involve tech-enabled processes, and this percentage continues to accelerate.

Strategic imperatives for life science executives

The decade from 2015 to 2025 provides unambiguous evidence that technology integration separates market leaders from followers. Organizations seeking to capitalize on expedited pathways and first-in-class opportunities must address several strategic imperatives:

Build or acquire AI and data science capabilities. The most successful companies have established extensive AI partnerships spanning drug discovery (target identification, compound screening), clinical development (trial design, patient selection), and commercial operations (market analytics, patient engagement). Whether through internal development, strategic partnerships, or acquisitions such as Roche's purchase of Flatiron Health, access to advanced analytics is now table stakes.[24][32][38]

Develop comprehensive RWE strategies. RWE is not merely supplementary—it has become essential for supporting approvals in challenging indications, securing label expansions, and demonstrating value to payers. Companies must invest in data infrastructure, establish partnerships with registry operators and health systems, and develop regulatory expertise in RWE submission strategies.[31][32][40][41][56][57]

Integrate digital health throughout development. Digital endpoints, remote patient monitoring, and patient engagement platforms are transforming clinical trials. Organizations must move beyond viewing these as ancillary tools and instead embed them into core development strategies, capturing continuous data streams that enrich evidence packages and support regulatory submissions.[23][28][47]

Pursue strategic technology partnerships. The complexity and pace of technological change makes comprehensive in-house development impractical for most organizations. Leading companies have established portfolios of strategic partnerships with technology providers, ensuring access to cutting-edge capabilities while maintaining focus on core pharmaceutical expertise.[27][28][24]

Adopt agile regulatory strategies. The proliferation of expedited pathways requires sophisticated regulatory planning. Organizations must develop capabilities in pathway selection, early FDA engagement, and adaptive trial designs that can capitalize on breakthrough therapy, accelerated approval, and other mechanisms.[6][7][13][14][48]

Conclusion: technology integration as a strategic imperative

The transformation of the FDA regulatory landscape over the past decade is inextricably linked to the rise of AI, digital health, and real-world evidence. Market-leading life science organizations are distinguished not merely by scientific innovation, but by how seamlessly they integrate advanced technologies into discovery, development, regulatory, and commercial strategies.

The evidence is compelling: companies leveraging these tools achieve higher approval rates, faster regulatory timelines, greater success with first-in-class innovations, and stronger commercial outcomes. The gap between technology leaders and laggards continues to widen, with tech-enabled approaches now representing over 70 percent of approvals at top pharmaceutical companies.

For life science executives, the strategic imperative is clear. Organizations must accelerate investment in AI and data science capabilities, develop comprehensive RWE strategies, integrate digital health throughout development, and build portfolios of strategic technology partnerships. Those that successfully navigate this transformation will define the next era of pharmaceutical innovation, delivering breakthrough therapies to patients while securing sustained market leadership. Those that hesitate risk irrelevance in an industry where regulatory agility and data capability have become the primary determinants of competitive success.

References

U.S. Food and Drug Administration. "New Drug Therapy Approvals Annual Report, 2024." Link

Li, B., et al. "Real-World Evidence in FDA Approvals for Labeling Expansion." PLoS Medicine, 2025. Link

DelveInsight. "Digital Therapeutics Market Outlook, 2025." Link

U.S. National Institutes of Health. "FDA Expedited Approval Mechanisms for New Drug Products." NIH White Paper, 2015. Link

Drug Patent Watch. "AI in Action: Accelerating the Drug Discovery Pipeline." 2025. Link

InsightAce Analytics. "AI-Powered Real-World Evidence Solutions Market Report, 2025." Link

Science AAAS. "The Drugs of 2015 to 2021." Science, 2023. Link

U.S. Food and Drug Administration. "Use of Real-World Evidence in Regulatory Decision Making." 2025. Link

Agilisium. "Winning the Market Access Game: AI & RWE in Pharma's Competitive Edge." 2025. Link

Pharma Intelligence. "Pharma Companies Leveraging AI/RWE/Digital Tools (compiled data), 2025." Link

U.S. Food and Drug Administration. "2024 New Drug Therapy Approvals Annual Report." PDF Link

U.S. Food and Drug Administration. "Digital Health Technologies for Drug Development." 2025. Link

McGuireWoods. "Rethinking FDA's Accelerated Approval Pathway: New Draft Guidances and Implications for Drug Companies." 2025. Link

U.S. Pharmacist. "Novel Drug Approvals in the United States." 2022. Link

PMC. "Real-world evidence to support regulatory submissions." 2024. Link

BLA Regulatory. "Snapshot of US FDA Drug Approval Trends 2024-25." 2025. Link

PMC. "Real-World Evidence in FDA Approvals for Labeling Expansion." 2025. Link

BiopharmaDive. "FDA's new accelerated pathway may open pharma up to risks." 2025. Link

FDALawBlog. "RWE and AI: Hand in Hand in the Future of Regulatory Decision Making." 2025. Link

Health Affairs. "Expedited Approval Pathways." 2017. Link

MWE. "FDA teases faster approval times with new agency-wide AI tool." 2025. Link

Fortrea. "Leveraging expedited programs in oncology: How accelerated approval works." 2025. Link

FDALawBlog. "New Accelerated Approval Guidance Underscores Need for Accountability." 2024. Link

Ozmosi. "Value of FDA Accelerated Approval in Drug Development." 2025. Link

The Financial World. "AI-focused Partnerships of Global Pharmaceutical Companies." 2024. Link

Pulse Health Tech. "The Digital Transformation Landscape of Pharma in 2025." 2025. Link

InsightAce Analytics. "AI-Powered Real-World Evidence Solutions Market Size." 2025. Link

AccelaBrand. "How Top Pharma Brands Use AI to Power Smarter Marketing." 2025. Link

PwC. "What is the value of real-world data in pharma." 2023. Link

PMC. "Enhanced Patient-Centricity: How the Biopharmaceutical Industry Is Leveraging Digital Innovation." 2022. Link

ZS. "Pharmaceutical industry trends 2025, outlook and strategies." 2025. Link

AACR Blog. "FDA Approvals in Oncology: April-June 2025." 2025. Link

AACR Blog. "FDA Approvals in Oncology: July-September 2025." 2025. Link

U.S. Pharmacist. "Recent Trends in Approvals of Novel Drugs." 2021. Link

Health Affairs. "First-In-Class Drugs Experienced Different Regulatory Treatment." 2025. Link

PMC. "Orphan drugs and accelerated approvals." 2024. Link

Drug Patent Watch. "AI in Action: Accelerating the Drug Discovery Pipeline." 2025. Link

ICER. "The Next Generation of Rare Disease Drug Policy." 2022. PDF Link

PMC. "Special FDA designations for drug development: orphan, fast track, breakthrough therapy." 2023. Link

Hogan Lovells. "New FDA approval process promotes development of rare disease gene therapies." 2025. Link

PMC. "Harnessing digital health technologies and real-world evidence to transform drug development." 2025. Link

Premier Research. "Translating FDA Guidance into Action: Regulatory Considerations for Orphan Drug Developers." 2025. Link

Harvard Wyss Institute. "From Data to Drugs: The Role of Artificial Intelligence in Drug Discovery." 2025. Link

Compiled data from fda_expedited_pathways_2015_2025.csv

Compiled data from pharma_companies_tech_strategy_2015_2025.csv

USC Schaeffer. "Impacts of First-in-Class Drug Approvals on Future In-Class Innovation." 2024. PDF Link

Agilisium. "Winning the Market Access Game: AI & RWE in Pharma's Competitive Edge." 2025. Link

Envision Pharma Group. "AI-powered real-world evidence: Strategically enhancing value and access." 2024. Link

Arnold Porter. "FDA Issues New Draft Guidance for Expedited Program for Serious Conditions." 2024. Link

ScienceDirect. "Global first-in-class drugs approved in 2023-2024." 2025. Link

Health Ark. "Using RWE to Strengthen Pharma GTM & Commercialization." Link

Viseven. "Real-World Evidence in Pharma: Unlocking New Insights." 2025. Link

Precision Medicine Online. "With New Authorities, FDA Continuing to Balance Access, Uncertainty in Accelerated Approval Pathway." 2025. Link

DCAT Value Chain Insights. "Up or Down: The Key Trends in New Drug Approvals." 2024. Link

Pentavere AI. "5 Top Real World Evidence Startups Impacting The Pharma Industry." 2022. Link

BMJ. "Trends in utilization of FDA expedited drug development programs." 2025. PDF Link

Hematology & Oncology. "FDA Regulatory Pathways for Expedited Drug Development and Approval." 2025. Link

CovingtonDigitalHealth. "FDA Requests Public Comment on Real-World Evaluation of AI-Enabled Medical Devices." 2025. Link

Verana Health. "How AI and Real-World Data Are Transforming Pharma Commercialization." 2025. Link